This quarter, real estate is showing some interesting changes. Prices are shifting, homes are taking longer to sell, and buyers are becoming more cautious. If you’re planning to buy, sell, or invest, this update will give you a clear picture of what’s going on right now. I’ve gone through real numbers and real reports, and I’m here to break it down for you, no fluff, just the facts and what they mean for you.

Q3 2025 Real Estate Market Report

In Q3 2025, the real estate market showed a mix of slowing price growth and rising inventory. Homes stayed on the market a bit longer, and more listings popped up, especially for condos. Buyers had more choices, and sellers had to price smart to stand out.

Median Home Prices in Q3 2025

Let’s talk numbers and what they really mean. In Q3 2025, median home prices changed in very different ways depending on the type of property. For single-family homes, prices increased slightly. On average, buyers were paying around $439,950, which was about 3.5% higher than the same time last year. That’s a steady climb, showing that this segment is still strong and in demand.

But it’s a different story for condos and townhomes. Their median price actually dropped by about 4.3%, landing around $365,000. That means sellers in that space had to adjust expectations, while buyers found a bit more wiggle room.

What makes this interesting is how these trends point to shifting preferences. Single-family homes still seem to hold value better, maybe because they offer more space, privacy, or land. Meanwhile, condos are starting to cool down a little, especially in spots where supply is rising faster than demand.

Now here’s a quick story from my side. A friend of mine was looking to buy a place this summer. She had her heart set on a cozy condo, something easy to manage, close to her work. But when we started looking, she noticed a lot more options than expected. And guess what? The prices weren’t climbing like before. She actually ended up getting a deal below asking. If this had been last year, that probably wouldn’t have happened. That moment told me more than the charts ever could: condo prices are softening, and the buyer has more power now.

So, what does this mean for you? If you’re thinking of buying a condo, this could be your window. If you’re selling a single-family home, the demand is still there, but pricing it right is more important than ever.

How Long Are Homes Staying on the Market?

When it comes to buying or selling a home, time really matters. One of the best ways to understand how hot (or cool) the real estate market is involves looking at a number called Days on Market, or DOM for short. Simply put, this is how long a home stays listed before someone buys it.

Single-Family Homes: A Slight Slowdown

For single-family homes, the average DOM increased to 24 days in Q3 2025. That’s about a 14% jump compared to last year. Based on data from the Central Virginia Regional MLS, the average days on market for condos increased to 37 days, while single-family homes took about 24 days to sell in Q3 2025. Now, 24 days might not sound like much, but in real estate, that’s a noticeable shift. It tells us homes aren’t flying off the market as quickly as they were in the red-hot seasons of the past.

Why the slowdown? Buyers are taking their time. With more listings to choose from and slightly higher prices, people aren’t rushing into deals. They’re thinking more, comparing more, and expecting more from what they buy.

For sellers, this means being patient and smart. The days of multiple offers in 24 hours are slowing down. If your house isn’t getting snapped up in the first week, that’s okay. It’s normal now. But you do need to make sure it’s priced right, looks great, and is listed with solid photos and details.

Condos and Townhomes: A Bigger Delay

Now, let’s talk about condos and townhomes, because they’re telling a different story. In Q3 2025, the average DOM for this segment jumped to 37 days, a 19% increase from last year. That’s a pretty big leap, and it shows that condos are cooling down faster than houses.

What’s going on here? The inventory for condos has grown more than the buyer demand. That means people shopping for condos have more to pick from. So they’re taking longer to decide. Some listings sit for a month or more before getting any offers.

This longer DOM is both a warning and an opportunity. If you’re a seller, don’t assume the first week will bring an offer; plan for a longer wait. If you’re a buyer? Good news. You probably have room to think, negotiate, and maybe even land a better price.

What the Longer DOM Means for You

These changes in Days on Market don’t mean the market is crashing, far from it. They just show that things are shifting toward balance. For a while, it was clearly a seller’s game. Now? It’s more even.

If you’re buying, you have more time to decide. You can visit more homes, compare prices, and not feel rushed. But don’t wait too long either, the best deals still go fast if they’re priced right.

If you’re selling, the key is knowing your market and setting the right expectations. Your home might not sell in a weekend, and that’s okay. Focus on showing it well, marketing it right, and being patient.

And for investors? A longer DOM can mean less competition and more chances to negotiate. It’s a smart time to look for properties that have been sitting for a while; sellers of those homes might be more willing to talk price.

The bottom line? Homes are still moving, but just not at lightning speed. Buyers are back in control of the clock, and sellers need to adjust. It’s not bad news, it’s just a new rhythm.

Inventory & Housing Supply: Is the Market Loosening?

One of the clearest signs that the market is shifting in 2025 is the rise in inventory and months of supply. These numbers help us understand how many homes are available and how quickly they’re selling, and right now, both are telling us the market is starting to open up for buyers.

Single-Family Homes: A Steady Climb

The inventory for single-family homes rose by 4.4% in Q3 2025. That’s not a massive jump, but it’s enough to give buyers a few more options. The months supply of inventory, which shows how long it would take to sell all homes at the current pace, increased to 1.9 months, up from last year.

- Inventory up: 1,618 homes available

- Months supply: 1.9 months

- Change: +5.6% year over year

This kind of change is what we call a “slow loosening.” It’s still a seller’s market in many places, but not nearly as tight as before.

Condos and Townhomes: A Bigger Shift

Now here’s where it gets more interesting. Condo and townhome inventory jumped by a huge 34.7% in Q3 2025. That’s a much faster change compared to single-family homes. And the months supply for condos rose to 3.0 months, a sign that this part of the market is softening more quickly.

- Inventory up: 672 homes available

- Months supply: 3.0 months

- Change: +25.0% year over year

Buyers in this space now have more power. They can shop around, take their time, and ask for better deals.

Quick Snapshot Table

Here’s a quick look at how inventory compares this quarter:

| Property Type | Inventory Count | Months Supply | Yearly Change |

| Single-Family Homes | 1,618 homes | 1.9 months | +5.6% |

| Condos/Townhomes | 672 homes | 3.0 months | +25.0% |

What This Means for Buyers and Sellers

- Buyers: More homes mean less pressure. This is a good time to compare listings and negotiate.

- Sellers: There’s more competition now. Pricing your home right and standing out really matters.

- Investors: Inventory is your friend. More supply often means better deals if you know where to look.

The market isn’t crashing, it’s just giving everyone a bit more breathing room.

New Listings & Sales Flow: What’s Moving, What’s Not

Understanding how many homes are being listed and how many are actually selling gives us a clear window into real-time demand. In Q3 2025, we saw changes in the number of new listings, pending sales, and closed sales , and they’re telling us which parts of the market are moving and which ones are starting to slow down.

Single-Family Homes: Modest Growth

The single-family home segment had a small bump in activity this quarter.

- New Listings: 3,500 homes (up 4.4%)

- Pending Sales: 2,694 homes (up 4.7%)

- Closed Sales: 2,758 homes (up 2.1%)

This shows that while more homes are hitting the market, buyers are still stepping in , just not as fast as before. It’s a sign of stable but cautious demand.

Condos and Townhomes: Busy Listings, Slower Closings

This part of the market saw more movement, but not all of it led to sales.

- New Listings: 1,016 homes (up 11.3%)

- Pending Sales: 703 homes (up 3.7%)

- Closed Sales: 753 homes (up 13.4%)

There’s clearly more listing activity in condos and townhomes, but the gap between what’s listed and what’s closing is wider. It’s a hint that while interest is there, buyers are more selective or waiting for better deals.

Interpreting the Numbers

- More listings don’t always mean more sales. Just because sellers are active doesn’t mean buyers are rushing in.

- Pending sales rising slowly? That could mean buyers are thinking longer, negotiating harder, or backing out more often.

- Closed sales still growing? That’s good, but if they don’t keep pace with listings, we could see even more inventory building up.

What This Means for You

- Buyers: You have more to choose from. Look at how long homes stay listed; a longer time often means more room to negotiate.

- Sellers: You need to stand out. Pricing, presentation, and flexibility make all the difference.

- Investors: Keep an eye on listings that sit longer than 30 days; they may lead to better deals with motivated sellers.

The activity is still there, homes are being listed and sold. But the pace has changed. It’s not about speed anymore. It’s about smart moves, timing, and knowing what’s really selling.

Affordability & Negotiation Trends

If you’re buying or selling a home right now, price isn’t the only number that matters. You’ve got to look at how much people are actually paying compared to the asking price, and whether the market still feels affordable. In Q3 2025, the numbers show that negotiation is making a quiet comeback, and buyers are starting to push back, just a little.

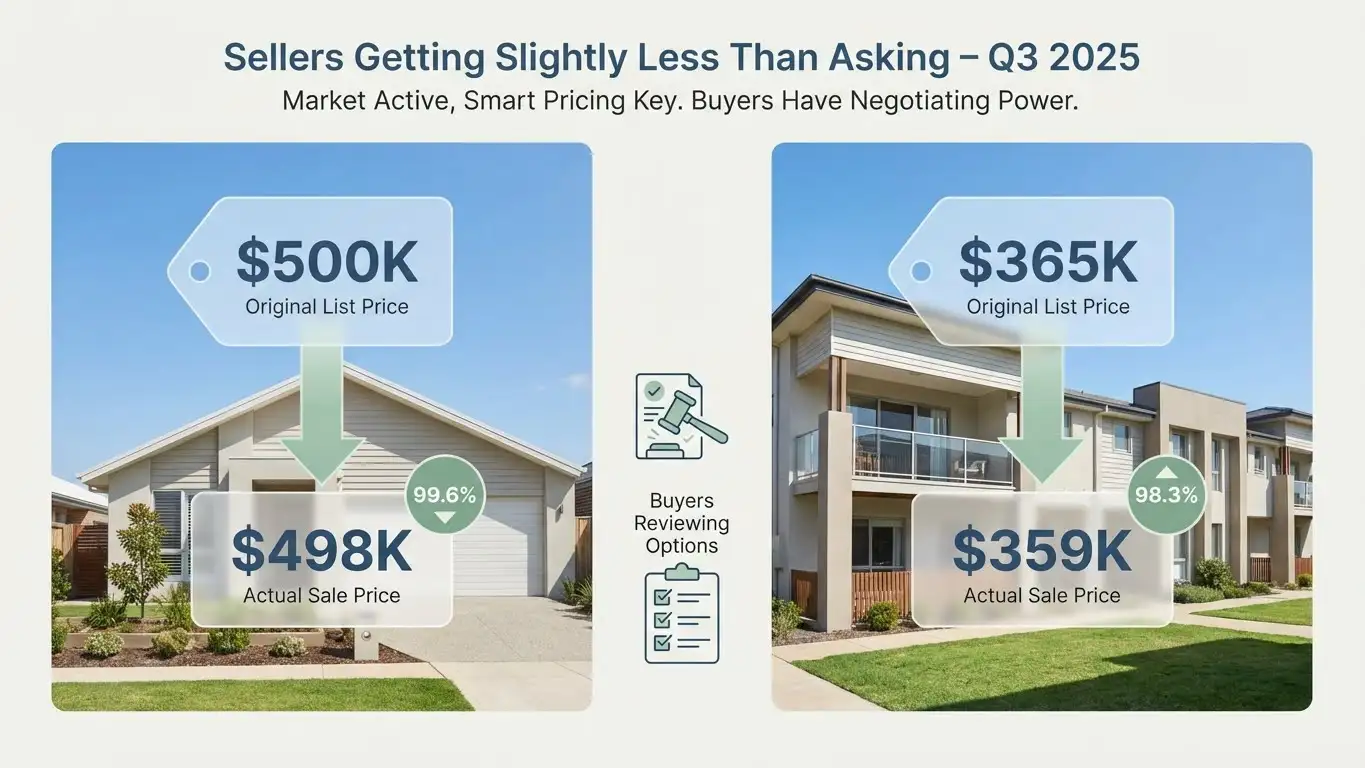

Sellers Getting Slightly Less Than Asking

Let’s start with this: homes are still selling well, but not always at full price. On average, single-family homes sold for about 99.6% of their original list price. That’s down about 1.3% from last year. For condos and townhomes, the ratio dropped even more, to 98.3%, a 1.7% decline.

So what does that tell us? Sellers are still getting close to what they want, but they’re not getting above asking like they used to. That bidding war energy we saw in earlier years has calmed down. Now, a home priced too high might just sit longer. And when it does sell, the price may come down a little.

This doesn’t mean the market is weak; it just means it’s getting a bit more balanced. Sellers are having to listen to buyer feedback, and buyers are feeling more confident in asking for fair terms.

Affordability Is Getting Tougher

Now let’s talk about the bigger picture: affordability. The Housing Affordability Index dropped again this quarter. For single-family homes, it went from 102 to 98, a 3.9% decrease.

What that means is simple: it’s a little harder for the average person to afford a home than it was a year ago. This drop reflects a mix of things: price increases, interest rates, and household income trends. When the index goes down, it usually means buyers need to stretch more to make a deal work.

So, if you’re a buyer, you might already be feeling it. Payments feel a bit heavier. The monthly costs add up faster. That’s where negotiation starts to matter. More people are asking for closing cost help or price reductions, and in many cases, they’re getting it.

If you’re selling, this is your cue to really know your market. Price is too high, and buyers will wait you out. Price smart, and you’ll still move quickly, maybe even get multiple offers, but only if the value’s clear.

Final Thoughts

The Q3 2025 real estate market is changing, not crashing, just shifting. Prices are still strong for single-family homes, but condos are seeing some softness. Inventory is growing, homes are taking a bit longer to sell, and buyers finally have more breathing room.

If you’re buying, this is a smart time to shop carefully and negotiate. If you’re selling, focus on pricing right and standing out. And if you’re investing, the rise in supply could open up some solid opportunities.

The key takeaway? Stay informed, be flexible, and don’t rush. The market’s still active, just moving at a more thoughtful pace.

Ready to Make a Move?

Whether you’re planning to buy, sell, or invest, having the right guidance makes all the difference. I work closely with clients to make smart, confident choices, no pressure, just honest advice backed by local market data.

If you’re looking to navigate the real estate market with clarity, let’s talk today. I’m here to help you every step of the way.

Frequently Asked Questions

Are home prices still going up in Q3 2025?

Yes, but only for some types of homes. Single-family home prices have gone up slightly, while condo and townhome prices have actually gone down a bit. It depends on what kind of home you’re looking at.

Is it still a seller’s market?

Not as much as before. Inventory is rising, especially for condos. That means buyers have more choices and sellers need to price smart. It’s more balanced now.

How long do homes take to sell now?

On average, single-family homes take about 24 days, and condos take around 37 days to sell. That’s longer than last year, so buyers can take a little more time.

Can I negotiate on price right now?

Yes, you can. Most homes are selling slightly below the list price, and buyers are starting to negotiate more. This is especially true for homes that have been sitting for a while.

Is now a good time to buy, or should I wait?

It depends on your situation. If you find a home that fits your needs and is priced right, it’s okay to buy now. Just take your time, compare your options, and don’t be afraid to negotiate.